To Attract the Ultra-Wealthy, Partner With Them – Episode 13

The wealthiest investors today aren’t content to let their advisors fully take the wheel when it comes to making decisions about their assets. To the contrary, they want a hands-on role in investment management—partnering with their advisors in the decision-making process so they feel they’re involved in “steering the ship” as they seek to build and protect their wealth.

This desire for active involvement has some big implications if you want to move upmarket and attract (and retain) more affluent clients to your practice.

Key Takeaways:

- The vast majority of the ultra-wealthy want to be actively involved in day-to-day investment management decisions.

- A whopping 94.9% of this age group want active involvement in the day-to-day management of their investments.

- Position yourself as your clients’ CFO and use tech to deliver a hands-on experience.

FACE THE FACTS

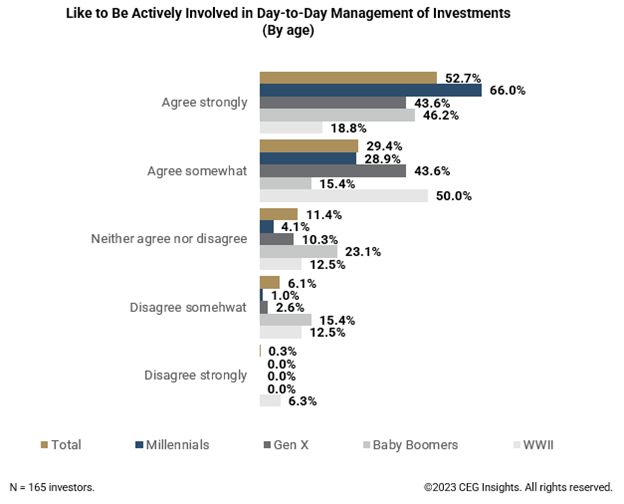

CEG Insights research reveals that the vast majority—82.1%—of ultra-wealthy investors with more than $25 million of net worth* agree strongly or agree somewhat that they want to be actively involved in day-to-day investment management decisions (see the chart).

What’s more, a mere 6.4% have little to no interest in being actively involved in this key area of wealth management.

Among millennials, this hands-on approach is a nearly universal desire: A whopping 94.9% of this age group want active involvement in the day-to-day management of their investments. When you consider that millennials represent 43% of the ultra-wealthy market today, that’s a lot of potential clients who want to have a role in the investment process.

INSIGHTS INTO ACTION

Clearly, these findings call for financial advisors courting wealthy investors to adopt a collaborative approach to investment management—particularly with younger clients. That doesn’t mean you need to contact them every day. But it does mean you should be in regular communication with them—providing updates on their financial situation, and learning about changes in their personal lives that may call for adjustments to their investments.

It also means that while you can present options and recommendations, you should jointly make decisions with your clients. By treating clients like partners in the decision-making process, you’ll develop stronger and more loyal client relationships.

Here are some key action steps to consider that can give clients the active engagement and participation they seek when making investment decisions:

- Learn how each client wants to be involved. Being part of the investment process will mean different things to different clients. Some might want you to run your ideas by them, while others may prefer to work closely with you to identify and vet potential opportunities. Regardless, you need to know how your wealthy clients and prospects want to be involved, and how they want you to communicate ideas to them. For example, how many times per year do they want to meet with you—and what information do they want to go over during those discussions? Best bet: Use an ongoing discovery process to get clarity on these issues.

- Be ready to customize. Based on what the ultra-wealthy tell you, be ready to be flexible with your service model and your investments. The ultra-wealthy tend to share many of the same goals and challenges that we see among the mass affluent, but they want more advanced and customized solutions to address those concerns.

- Build a CEO-CFO type relationship with clients. Often, the ultra-wealthy have become successful through business ownership or their activities in the business world. One effective way to show them the partnership they have with you is to frame your relationship in business terms they’ll appreciate. For example, the client is essentially the CEO and you (the advisor) are their CFO—working with them to strategize and plot the right financial course.

- Use technology to boost client engagement. Each month, conduct an online meeting about the markets and your portfolios, and invite clients to join and share their thoughts. This can be a very effective and efficient way to connect the dots for high-net-worth investors who want to feel like they’re hands-on and involved in the decision-making process.

- Explore non-traditional assets together. Discussing unique or alternative investment options with ultra-wealthy clients and prospects can make them feel more deeply embedded in the investment process with you. Whether it’s real estate, oil and gas partnerships, crypto or something else entirely, exploring these areas with clients will send a message that you’re a true collaborator and partner—even if you decide together to ultimately not invest in them.

SCHEDULE YOUR FREE PLAY TO WIN CONSULTATION NOW