What It Takes to Serve the Ultra-Wealthy – Episode 12

Some of you reading this—maybe even a lot of you—don’t have any clients with a net worth of $25 million or more. Others might have one or two of these ultra-wealthy clients, but they’re outliers rather than the focus of your business model.

There’s no law saying you have to serve the ultra-wealthy, of course. If you’re happy and successful serving clients with lower net worths, go right ahead and keep on doing what you’re doing. But in our experience, many advisors look at the ultra-wealthy space with a great deal of envy. They want these clients—but they don’t think they can serve them well. The result: They spend their careers wishing they could move upmarket, but being too fearful to take action.

The good news: It turns out that investors with $25 million or more in net worth probably aren’t all that different in key ways than the clients you’re serving today—which means you might be better positioned to serve them than you think.

Key Takeaways:

- Investors with $25 million or more in net worth probably aren’t all that different in key ways than the clients you’re serving today.

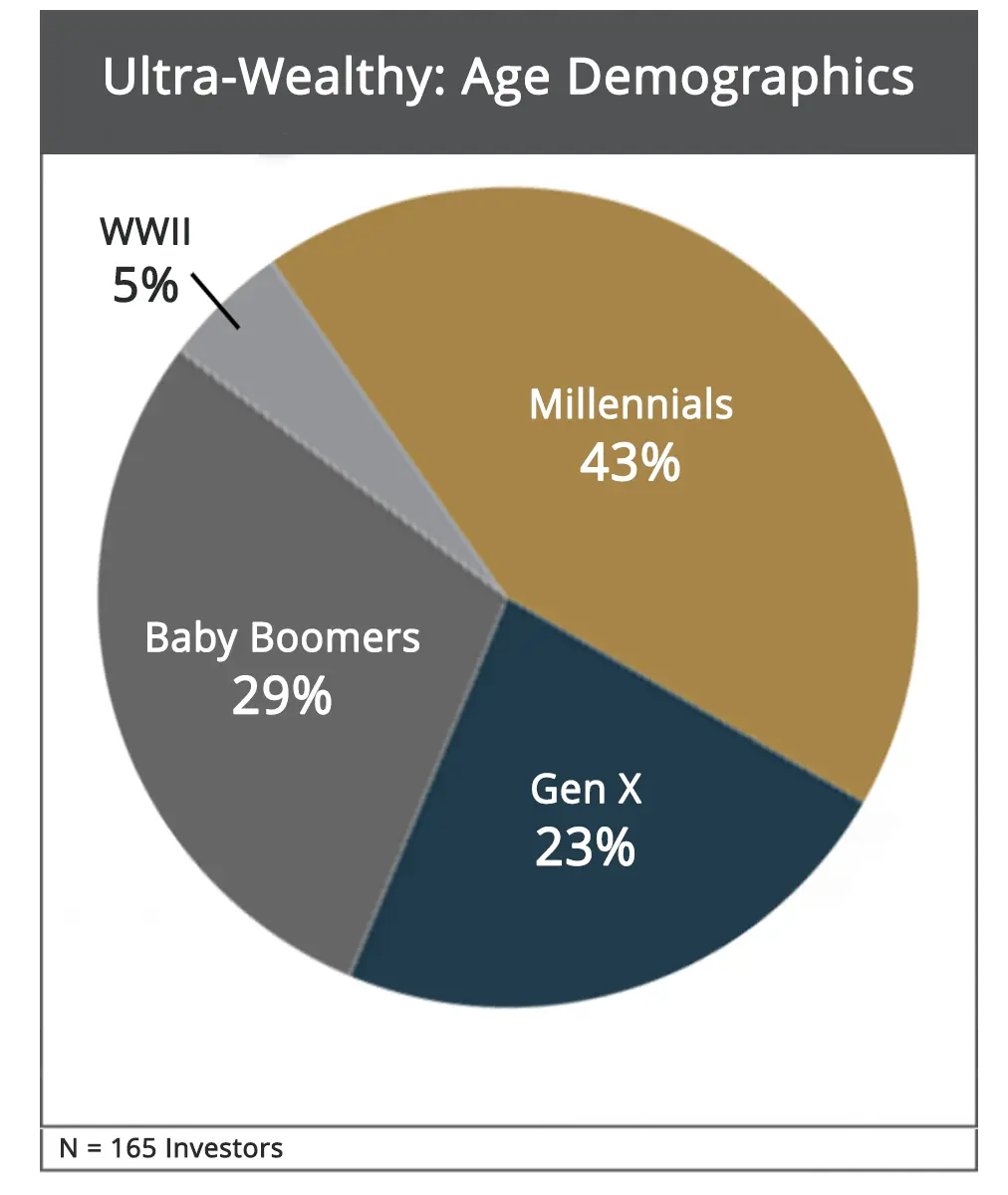

- Millennials—those born between 1981 and 1995—make up a surprisingly large percentage of today’s ultra-wealthy investors.

- By assembling and coordinating a virtual family office, advisors can offer the expertise that the ultra-wealthy want.

FACE THE FACTS

CEG Insights research reveals that millennials—those born between 1981 and 1995—make up a surprisingly large percentage of today’s ultra-wealthy investors. As seen in the chart, 43% of the ultra-wealthy are millennials—versus baby boomers (29%), Gen-X (23%) and the WWII generation (5%).

Ultra-Wealthy: Age Demographics

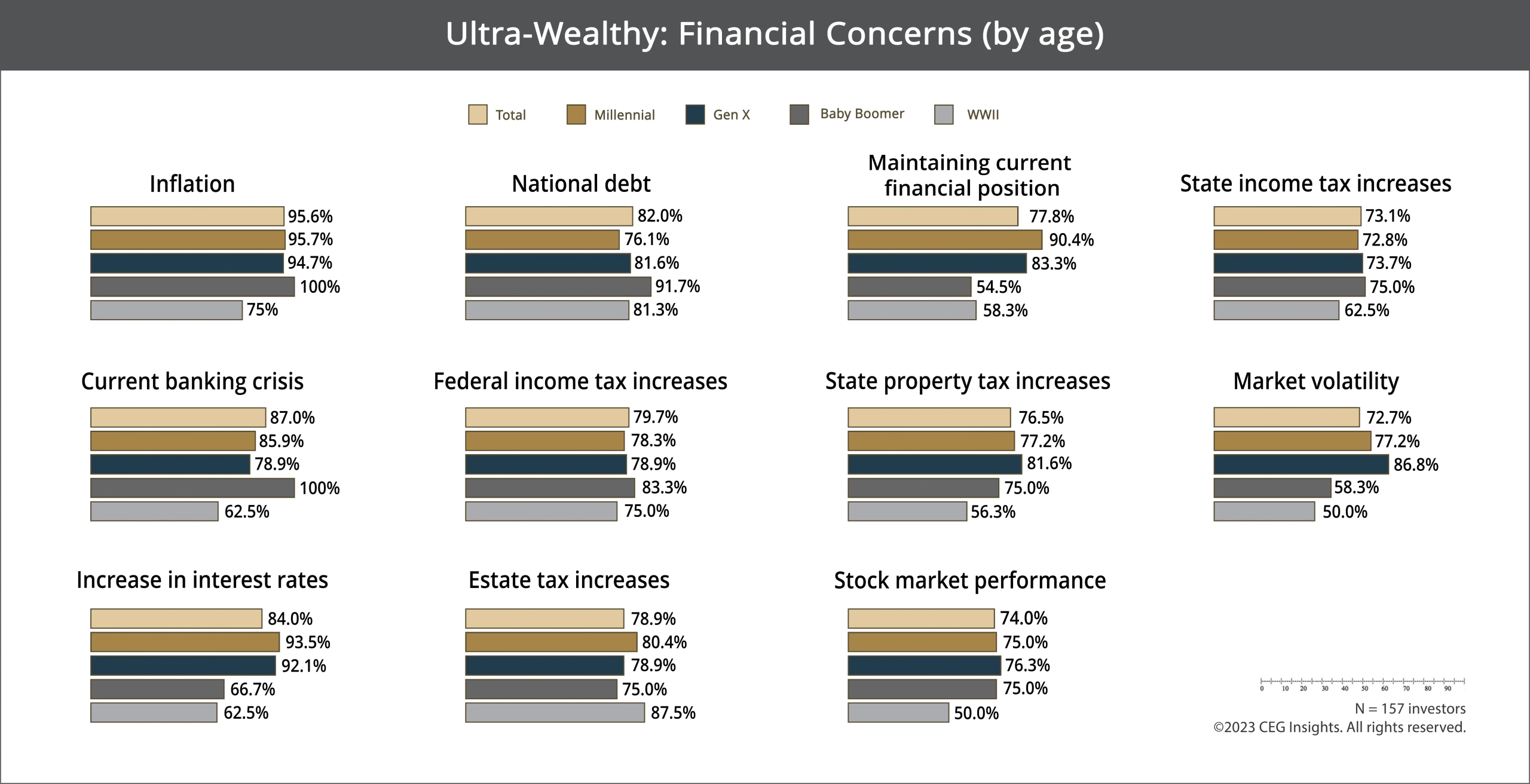

CEG Insights also found that these ultra-wealthy investors share a number of key concerns, shown in the next chart.

Ultra-Wealthy: Financial Concerns (by age)

Notice anything about the ultra-wealthy’s concerns? They’re, by and large, the same types of worries and issues that are on your existing clients’ minds! Inflation, interest rates, taxes, market performance, the national debt—these are all concerns most advisors today are helping their “merely” affluent clients navigate.

The upshot: The ultra-wealthy share plenty in common with your current clients.

INSIGHTS INTO ACTION

Of course, these commonalities don’t mean the ultra-wealthy are exactly the same as, say, mass affluent clients. A key difference is that the ultra-affluent are looking for a family-office type of wealth management experience–an integrated, coordinated approach to managing their financial lives. Seven out of ten, or 70.8%, are somewhat or very interested in such a service delivery. Among millennials, that desire is nearly universal—96.5%.

Family offices combine exceptional wealth management with customized attention to administrative and lifestyle matters, along with the capacity to deal with important one-off special projects. By providing extensive, coordinated solutions that address investors’ financial situations and many aspects of their well-being, family offices can build and protect their personal wealth while making their lives a whole lot easier and more enjoyable.

How realistic is it for most advisors to provide a family office experience? Traditional single-family offices cater to the seriously wealthy—often families with more than $500 million in net worth. However, advances in technology, along with the ability to deliver more—and more sophisticated—wealth management solutions to a wider range of investors, are giving the traditional family office concept new traction in the form of virtual family offices.

By assembling and coordinating networks of specialists, usually virtually and without regard to geographic location, advisors can offer the expertise that once was available only from traditional family offices—and do so for clients in the $25 million+ category.

This is not to say it’s an easy task, of course. Building a successful virtual family office takes a great deal of time and effort. But it’s certainly possible, especially given the growing number of resources aimed at helping advisors create virtual family offices. By combining what you already do for clients with a business model that empowers you to do even more, you can play to win in the ultra-wealthy space.

SCHEDULE YOUR FREE PLAY TO WIN CONSULTATION NOWSave