HNW Holistic SOS: Your Mission to Revitalize Wealth Management – Episode 14

Financial advisors today have an extraordinary opportunity to attract, serve and retain ultra-wealthy clients—those with a net worth of $25 million or more.

The key to making that happen: Bring additional expertise into these clients’ financial lives and coordinate the efforts of the professionals who possess that expertise.

The fact is, far too many of these highly affluent investors are not getting—or don’t recognize they’re getting—important services that could add tremendous value to their lives. Nor are they enjoying the benefits that come when those services work in concert with each other to deliver better, more comprehensive outcomes.

Here’s how you can take steps right now to start capturing the ultra-affluent opportunity.

Key Takeaways:

- A surprisingly high percentage of ultra-wealthy investors don’t appear to work with accountants or attorneys.

- Bringing non-investment expertise into your clients’ lives can help you add tremendous value.

- Working closely with other experts can also potentially put you in front of more ideal prospective clients.

FACE THE FACTS

CEG Insights recently asked ultra-wealthy investors about the various types of advisors they use. Shockingly, no single type was selected by a majority of these investors. For example:

- Just 44.6% of the ultra-affluent work with an accountant.

- Just 31.7% have an attorney.

In our view, these numbers should be much closer to 100% given this group’s net worth and the financial complexities that typically accompany such wealth.

It is possible that some of these ultra-affluent investors are actually getting their accounting, tax and legal needs met (through, say, their relationship with a multi-family office). Even if that’s the case, however, a large percentage of them clearly don’t realize or understand which types of professionals are part of their lives—a problem that could be good news for you.

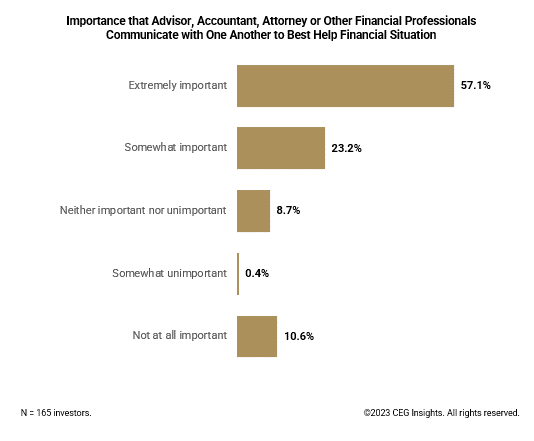

Our research also indicates that the ultra-wealthy want coordination of their financial lives: Four out of five (80.3%) believe that it is either extremely or somewhat important for their financial professionals to communicate with each other (see Exhibit). Just 11% find such coordination to be unimportant.

Importance That Advisor, Accountant, Attorney or Other Financial Professionals Communicate With One Another to Best Help Financial Situation

INSIGHTS INTO ACTION

These findings have potentially huge implications for the success of your advisory practice, especially if you seek to move upmarket and serve highly affluent, highly desirable clients.

If you have clients with at least $5 million in investable assets—maybe even $1 million—and they don’t have relationships with accountants or attorneys, help them identify high-quality professionals in these two crucial areas of comprehensive wealth management. Ideally, you should build your own network of experts that includes the key professionals your ideal clients need (a strategy we’ll cover in an upcoming podcast, by the way).

If these clients do already work with an accountant and an attorney, you should learn who they are and get to know them. Part of your client discovery process should involve learning about your clients’ other advisors. The ultimate goal is to position yourself as the coordinator of all those relationships—the main point of contact who ensures all the strategies implemented by these various professionals are in your clients’ best interests and that the solutions work well together as part of a larger wealth management plan.

Working closely with your clients’ other advisors comes with three major benefits:

- You are able to better serve your clients and add value because you have a full picture of their financial life, needs and strategies.

- Your clients, seeing the additional value you’re bringing to the table, invest more of their assets with you.

- Your clients’ other advisors can potentially become important referrals sources for you.

It’s all-too-easy to assume that the ultra-rich are all set—that they’re working with the right professionals and their financial lives are fully on track. But the fact is, many of them need your help to access the services they need and coordinate the many moving parts. By stepping up and giving them that guidance, you can position yourself as the go-to advisor to some of the wealthiest clients out there.

SCHEDULE YOUR FREE PLAY TO WIN CONSULTATION NOW