The Importance of Legacy Planning For Your Clients—And Your Practice – Episode 16

Many of your affluent clients and prospects are thinking more and more about legacy these days—specifically, how they can transfer not just assets but also their values and beliefs to their heirs.

For your clients to be able to preserve their wealth and use it purposefully across generations, you should effectively engage them—and, importantly, the next generation—in the area of legacy planning.

Key Takeaways:

- Affluent clients plan to leave the bulk of their assets to their heirs.

- Most affluent clients want their kids to continue working with their current advisors.

- Connect with younger generations—and potential future clients—through family meetings and other types of outreach.

FACE THE FACTS

When CEG Insights asked investors with $25 million or more of net worth about their wealth, the vast majority—85.8%—said it’s extremely or somewhat important to them that they leave a legacy that includes passing down both wealth and values.

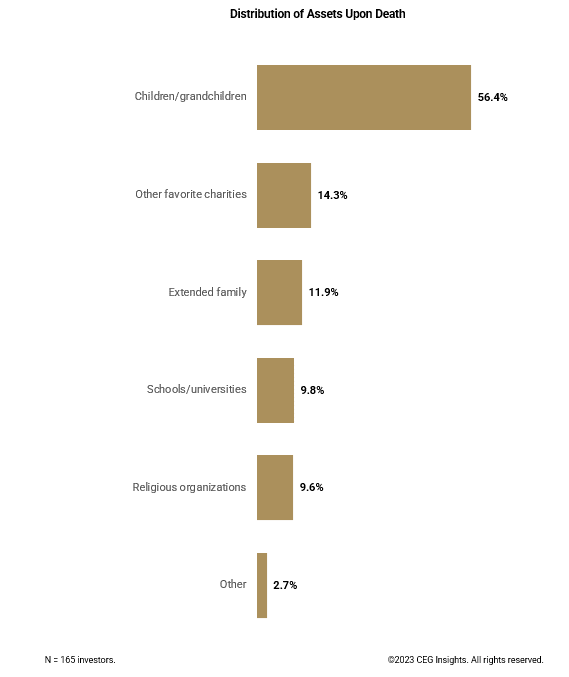

Perhaps not surprisingly, the most likely recipients of that inheritance are children and grandchildren. More than half (56.4%) of investors want their assets distributed to kids and grandkids upon death. That’s far more than other responses such as charities and alma matters (see the chart).

The upshot: You stand to gain a lot if you start building relationships now with your clients’ heirs and engage with them about their financial goals, interests and needs. When you build relationships with the next generation, you increase the likelihood that those heirs will continue to use your services after inheriting their parents’ wealth. This helps ensure the continuation of a wealthy client base, providing long-term stability and growth to your practice.

Just as important, there are significant benefits to the family. When you understand the financial situations, goals and values of multiple generations, you can craft plans and provide a range of services that address the broader family’s interests and intergenerational concerns. Involving adult children in the discussions can help ensure that there’s a smooth transition of wealth and continuance of financial strategies that are already in place.

When family businesses are involved, that involvement can be crucial in the smooth transition and continued success of the enterprise. And should something unexpected happen to the parents, such as sudden illness or death, having the adult children involved can prevent gaps in the management of the family’s financial affairs.

Our research turns up some very good news for advisors serving the ultra-wealthy: These investors are very much predisposed to having their children and grandchildren work with their advisor. For example:

- Three-quarters (75.1%) say that their children or grandchildren have already established a relationship with their advisor (or advisors).

- 2% believe it is important for their kids or grandkids to meet with the advisor.

- 0% will encourage them to use the same financial services firms.

INSIGHTS INTO ACTION

Here are four ways you may want to consider approaching legacy planning to ensure you’re engaging with the key family members and decision makers:

- Family meetings. Organize regular family meetings where multiple generations come together to discuss wealth, its implications and the family’s financial vision. This collaborative setting can serve as a platform for the older generation to share their values, experiences and goals.

- Joint ventures. When appropriate, encourage families to consider collaborative investment projects or philanthropic ventures where the older and younger generations work together. This provides practical experience for the younger generation and emphasizes the family’s values and legacy.

- Shared decision-making. Involve younger family members in decisions about investments, philanthropy and other financial matters. This gives them a sense of responsibility and offers a practical understanding of how wealth management works.

- Family goals. When legacy planning, advisors are entrusted with the profound responsibility of stewarding not just wealth but the aspirations, values, and dreams families wish to pass on. Develop an understanding of what families desire for their legacy beyond mere asset distribution. By grasping the essence of how families wish to influence future generations and make impactful contributions to the world, you can craft strategies that truly resonate with a family’s core values.

SCHEDULE YOUR FREE PLAY TO WIN CONSULTATION NOW