Is Your Tech House in Order? – Episode 20

Financial technology is a hot-button issue for many advisors as they attempt to offer tech that investors want and value, while also not going overboard with “bells and whistles” that clients are likely to ignore. Given how rapidly the tech landscape changes, that can be a tall order.

With that in mind, here’s a look at some of the ways today’s affluent clients view fin-tech.

KEY TAKEAWAYS

- Younger investors are more likely to expect access to fin-tech.

- Secure communication platforms are a key essential digital tool to provide.

- Communicate your tech offerings to your clients so they know what’s there for them.

FACE THE FACTS

CEG Insights recently surveyed more than 800 investors—all with at least $100,000 in net worth, but most with a net worth of at least $1 million.*

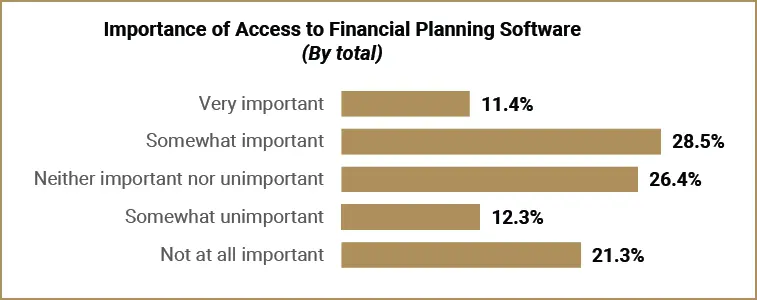

The research paints a conflicted picture of investors’ overall fin-tech preferences. For example, as seen in Exhibit 1.

- Nearly 40% of investors feel it is very or somewhat important to have access to financial planning software—likely because they want to see how various hypotheticals might impact their goals and outcomes.

- However, essentially one-third (33.6%) say access to this tech is somewhat unimportant or not at all important.

Exhibit 1

Of course, the affluent aren’t one monolithic group. It turns out that younger investors are much more likely to want access to financial planning software:

- 5% of millennials want financial planning software access.

- 5% of Gen X-ers want financial planning software access.

The research also found that numerous other types of digital tools and resources are valued by investors, to varying degrees. The three digital tools investors overall say are the most essential:

- Secure communication platforms (48.6%). Clients want to know that your system is well protected against data thieves, and that they can communicate with you securely (via encrypted messaging technology, for example).

- Performance reporting tools (30.1%). Clients want to be able to see how their investments are performing, of course.

- Tax optimization tools (22.6%). We find that tax mitigation is consistently the #1 or #2 concern of the affluent, overall.

Here again, however, some stark generational differences emerge:

- Nearly 30% of millennials see risk assessment tools as essential, versus just 14.3% of investors overall.

- Document vaults are seen as essential tools by 25.9% of millennials, compared to 17.7% of investors overall.

INSIGHTS INTO ACTION

Based on these findings, advisors should consider the following action steps:

- Consider your client base carefully. If you haven’t invested heavily in client-facing tech tools yet, you likely don’t need to panic. A lot of fin-tech just isn’t critically important to investors on the whole. A significant percentage of investors aren’t concerned about accessing financial planning software, for example—while even the top essential digital tools were deemed to be essential by less than 50% of investors surveyed.

That said, your tech strategy should reflect your current client base—and, importantly, the clients you’re increasingly likely to serve. Millennials, for example, possess significant wealth already and will likely make up a sizable percentage of advisors’ business going forward. Clearly, the research shows that millennials in many cases care about access to digital tools far more than other generations.

The upshot: If you want to “skate to where the puck is going,” it’s probably time to explore and implement the tech that younger clients value.

- Communicate what you offer in terms of fin-tech. Close to 60% of investors claim their advisors don’t offer them financial planning software. Frankly, that’s highly unlikely to be the case. But it suggests that advisors may not be doing a good enough job at showing clients the technology their practices offer and how to use it. Make a point to introduce clients to the digital tools that are available to them—and remind them (at regular progress meetings, for example) of what they have at their fingertips to help them on their financial journey.

SCHEDULE YOUR FREE PLAY TO WIN CONSULTATION NOW