Three More Strategies Used By Today’s Million-Dollar Advisors – Episode 34

You already know two strategies that today’s most successful financial advisors—those earning more than $1 million annually—use to generate their amazing results.

Here are three more—along with specific action steps you can take to implement those strategies into your own practice and start moving upmarket.

KEY TAKEAWAYS

- Help top clients understand how to best refer people to you.

- Consider a virtual family office business model.

- Use AI in ways that enhance the client experience.

FACE THE FACTS

CEG Insights surveyed nearly 1,100 financial advisors. Roughly half of them (49.3%) earn less than $500,000 annually, while 37% earn between $500,000 and $1 million a year. A select few—13.8%—earn more than $1 million a year.

Here’s what we learned about these top advisors in a few key areas:

- 46.9% of the $1 million-plus advisors manage more than $1 billion in AUM—versus less than 10% of advisors earning less. Interestingly, however, nearly one-quarter of the highest-earning advisors generate their sizable incomes managing between $101 million and $500 million in AUM—proof that success isn’t determined simply by AUM levels.

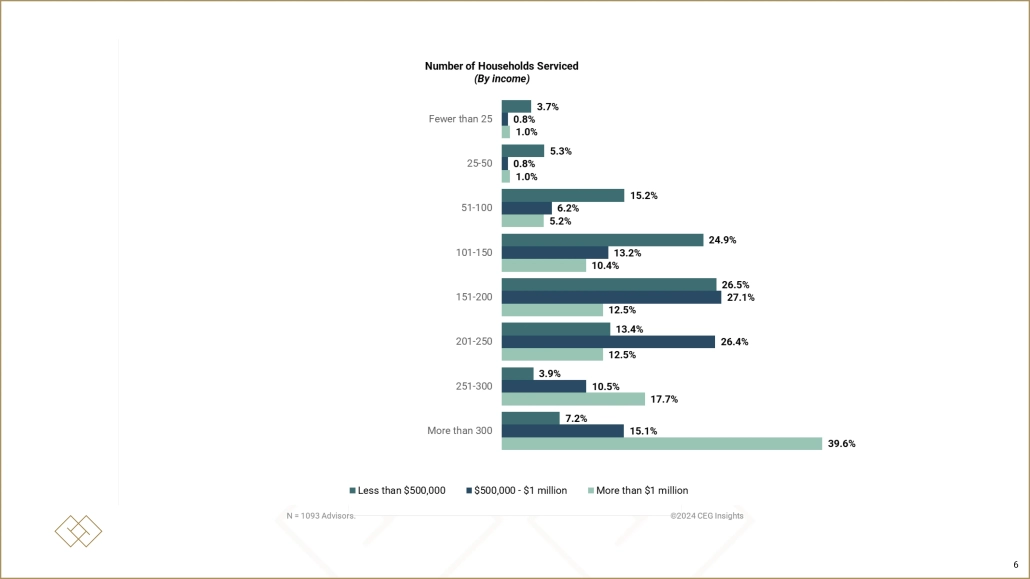

- Number of clients. Not surprisingly, the highest earners tend to serve the most number of client households (see Exhibit 1). But note that there’s differentiation even among the top advisors. Approximately 15% of them earn more than $1 million serving just 51 to 150 client households.

Exhibit 1: Number of Households Serviced (By income)

INSIGHTS INTO ACTION

Based on our research and our experience coaching financial advisors, we believe advisors who want to generate higher incomes should seriously consider implementing the following best practices:

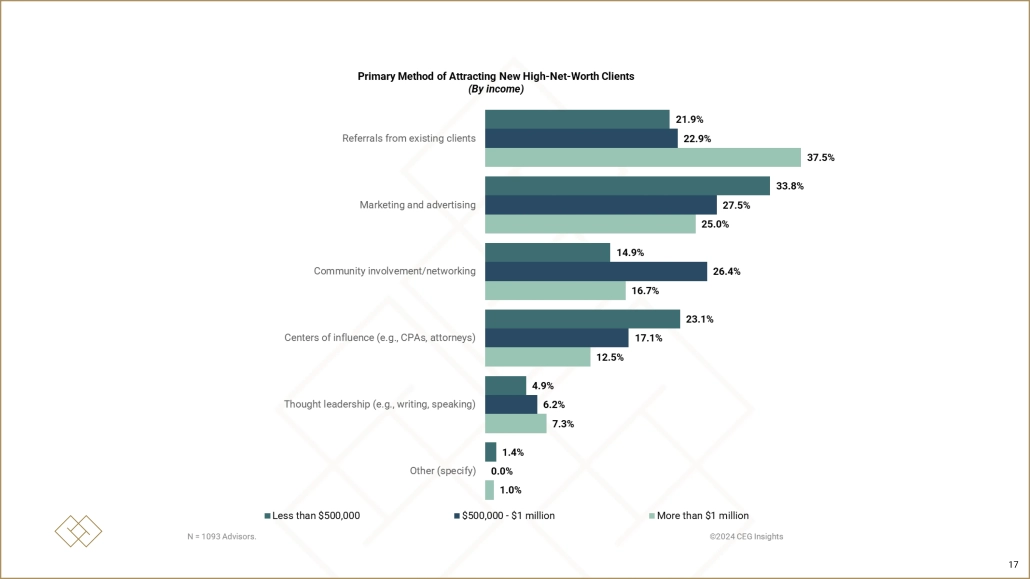

- Master client referrals. Referrals from existing clients are the key source of new business for top-earning advisors, as seen in Exhibit 2. They use other methods, too, but client referrals is their primary approach—and a clear difference-maker.

Exhibit 2: Primary Method of Attracting New HNW Clients

To increase your client referrals, take these steps:

- Offer second opinions. Let your clients know that you’d be happy to examine the current financial and investment situations of their family members, friends and colleagues to see whether those people are positioned for the future as well as they could be. If they are well-positioned, you’ll say so. If not, you can discuss ways they might improve their overall financial picture.

- Educate clients on how they should refer to you. Clients often think they’ve referred you if they tell a friend about you and give them your phone number. But, of course, those interactions rarely lead to new introductions. So help your clients understand how they can best send people your way if they want to do so, using your preferred process.

- Deliver highly-customized wealth management solutions. Among the $1-million-plus advisors, 52.1% say they offer customized, best-in-class solutions across all areas of wealth management. In stark contrast, just 21.3% of advisors making $500,000 to $1 million agree—and a mere 15.4% of advisors earning less than $500,000 say they deliver such solutions.

To join the ranks of the top advisors:

- Improve your advanced planning offerings. Provide solutions to the challenges that are most important to the affluent—such as business succession, asset protection and wealth transfer. You can deliver such expertise yourself or partner with providers who have the expertise in these areas.

- Implement a virtual family office approach. Advisors who adopt a VFO business model position themselves for significant success. Seven out of ten (70.8%) ultra-wealthy investors are somewhat or very interested in receiving family office services. Among millennials, the desire for these services is nearly universal—96.5%. Family offices combine exceptional wealth management with keen attention to clients’ administrative and lifestyle matters—as well as the capacity to deal with important one-off special projects that might arise.

- Incorporate AI into your practice. When asked which technologies they will implement going forward to enhance client service, 67.7% of top-earning advisors said AI and machine learning. Fewer than half of the lower-earning advisors agreed. Clearly, top advisors recognize the potential for AI.

Some ways in which you might bring AI to bear on your business include:

- Customized content and market. AI can help you produce emails, charts, articles and other forms of marketing materials quickly—so you can enhance the frequency of your client and prospect communications.

- Document review. AI can help summarize lengthy, complex documents such as estate plans or business succession plans—helping you understand such plans faster and helping clients better appreciate the key components of these plans.

SCHEDULE YOUR FREE PLAY TO WIN CONSULTATION NOW