Two Ways To Attract $25-Million-Plus Clients To Your Door – Episode 35

As an advisor, one of the smartest moves you can make is understanding the wants, needs and concerns of investors with $25 million or more in net worth. This cohort is important to the future of your business for a few key reasons:

- The trickle-down effect. The attitudes among the wealthiest clients out there today tend to flow downstream over time to less affluent groups of clients. When you see what the $25-million-plus cohort is doing, it’s essentially a leading indicator of what other types of clients will eventually want and even expect from their advisors. You can use that information to proactively position your practice for the future.

- Higher incomes. Not surprisingly, we find that advisors with the wealthiest clients tend to generate the highest incomes. Positioning your practice to attract these investors can be a key driver of your success going forward.

- A growing trend. We’re seeing a growing number of households with more than $25 million in net worth—and often those households are headed by younger generational groups such as Gen Xers and Millennials.

KEY TAKEAWAYS

- It’s smart to understand the needs of ultra-wealthy investors.

- Connect with your existing clients’ heirs.

- Get involved in the alternatives investments space.

FACE THE FACTS

CEG Insights surveyed 350 households that had $25 million or more in net worth, not including the value of their primary residence. Some of the key findings include:

- Source of wealth. Among the $25-million-plus group, inheritances have become a key source of wealth. Example: 86.6% of investors with $25 million to $49.9 million in net worth say their wealth came from an inheritance—while just 40.7% of that group said the wealth resulted from their own hard work.

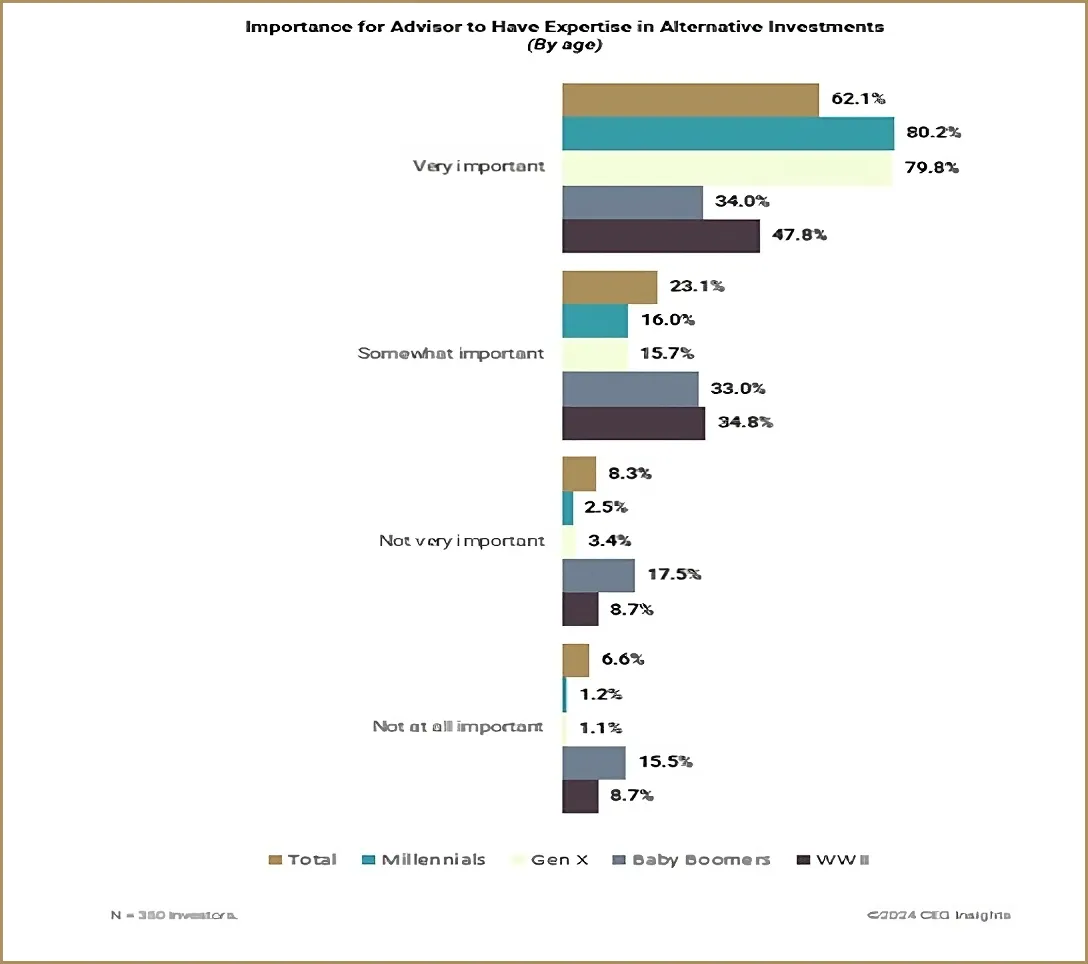

- Investment approach. These ultra-wealthy investors aren’t fundamentally different from other wealth groups in many ways when it comes to attitudes toward investing and risk management. However, they are extremely interested in alternative investments. A full 62.1% say they expect their advisors to have expertise in the area of alternative investing—and that percentage spikes to around 80% for Gen Xers and Millennials with $25 million or more in net worth (see the chart).

Exhibit 1: Importance for Advisor to Have Expertise in Alternative Investments (By age)

INSIGHTS INTO ACTION

Based on our findings, consider the following action steps:

- Connect with existing clients’ heirs. The huge transfer of wealth that’s been predicted for years is well underway. Build relationships with the heirs of your wealthiest clients. Get to know them and start presenting yourself as an expert who understands their future goals and needs. When assets are transferred to them, they’ll already see you as a trusted resource to work with.

- Provide expertise in alternative investments. Given the importance the ultra-wealthy place on alternative investments—which may include hedge funds, private equity, crypto and others—you need to be ready with expertise in these areas, or with access to expertise through your network. Just as important: If you choose to not offer access to certain types of alternative investments, you need to be able to explain your reasoning to these clients. Otherwise, they may simply assume that you’re ignoring investments they value.

Next time, we’ll dive even deeper into this ultra-wealthy group—revealing the key service gaps between what these investors want from their advisors and what they’re actually getting.

SCHEDULE YOUR FREE PLAY TO WIN CONSULTATION NOW